ShellNews.net: LETTER FROM ALFRED DONOVAN TO PRIME MINISTER TONY BLAIR REGARDING "CODES OF PRACTICE" GENERALLY AND SHELL'S STATEMENT OF GENERAL BUSINESS PRINCIPLES IN PARTICULAR: "The reserves scandal was of such global magnitude that it has brought about the demise of a great British company, The Shell Transport & Trading Company plc, which under the recently announced “merger” plan with Royal Dutch Petroleum Company, will cease to exist. The HQ for Royal Dutch Shell plc will be in Holland and the majority of senior management will be Dutch." Posted 25 Nov 04

24 November 2004

The Rt. Hon. Tony Blair MP

Prime Minister

10 Downing Street

London

SW1A 2AA

Dear Prime Minister

Voluntary Codes of Practice

A company that I co-founded sent a fax to you on 6th May 1997 (copy enclosed) concerning the Codes of Practice/Citizens Charters promoted by many organisations and businesses. We warned that our enquiries with Leading Counsel and other parties had revealed that they were unregulated and not subject to any law. This situation also applies to Social Corporate Responsibility Reports.

As a result, management of multinationals such as Shell can cloak themselves in fine words and stirring promises designed to generate confidence, trust and investment. In this connection, when we wrote to you, we quoted from a speech given by Shell Chairman Mark Moody-Stuart when he referred to Shell’s core principles – “of honesty, integrity and respect for people” with an almost religious fervour. He vowed: “We do not bend these Principles. They are non-contestable and non-negotiable.”

This is the same man who is a defendant in multi-billion dollar class action law suits alleging fraud in respect of Shell’s energy reserves scandal and gross human rights abuses in Nigeria including association with the hanging of the renowned Ogoni peace activist and Nobel Laureate, Ken Saro-Wiwa and his equally innocent colleagues. I received an email on 15 November 2004 from one of the Ogoni class action Plaintiffs, Anslem John-Miller (the son of Bishop John-Miller) indicating that prior to the trial proceedings, key prosecution witnesses swore Affidavits stating that they were bribed by Shell and the military government to give false testimony against Ken Saro-Wiwa. Further information about Shell’s activities in Nigeria is contained in the attached document entitled ANCILLARY INFORMATION. The reserves scandal was of such global magnitude that it has brought about the demise of a great British company, The Shell Transport & Trading Company plc, which under the recently announced “merger” plan with Royal Dutch Petroleum Company, will cease to exist. The HQ for Royal Dutch Shell plc will be in Holland and the majority of senior management will be Dutch.

We did not realise just how two faced Moody-Stuart’s passionate promises of fidelity were until we personally brought directly to his attention irrefutable documentary evidence of how Shell managers conspired to implement a plan which deliberately deceived and cheated several companies pitching for a multi-million pounds Shell contract which they wrongly thought was a fair tendering process. The contract was ultimately awarded to a company which did not even participate in the tendering process. Its directors had a close personal relationship with the Shell manager at the heart of the conspiracy, Mr Andrew Lazenby, who for some reason had an offshore bank account.

I still have the documentary evidence which proves how the plan was conceived and ruthlessly carried out by Mr Lazenby and his fellow Shell managers. Instead of sacking the individuals involved, Mr Lazenby was able to claim in a Witness Statement endorsement for his actions at the very highest levels of Shell. Incredulous at this assertion, we brought it directly to the attention of senior Shell management including Mark Moody-Stuart and Malcolm Brinded, inviting each of them to disassociate themselves from the claimed endorsement of the unscrupulous conduct which was totally at odds with Shell’s Ethical Code – its Statement of General Business Principles (hereinafter referred to as SGBP’s). No such retraction was forthcoming.

This is when the penny finally dropped. We realised that Shell was rotten at the core and that Moody-Stuart (now Sir Mark) is a hypocrite and a fraud. He looks like a vicar and is married to a saintly individual, Lady Judy Moody-Stuart, who to my great surprise instigated correspondence with me without her husbands’ knowledge. Her extraordinary handwritten letter gave a hint, probably unwittingly, to her husband’s pressurised situation “bearing huge responsibility” coupled with the perhaps revealing assertion that he “will not get any better” as a result of comments we made about him. I am aware that the New York law firm acting for the lead plaintiff in the major class action law suit against Shell in which Sir Mark is a named defendant has been advised to seek in due course the appropriate medical records for Sir Mark.

The remarks of Lady Moody-Stuart perhaps provide a clue to the genesis of the reserves crisis – an individual desperate for success in a highly pressurised environment while under almost sustained personal attack from many quarters in relation to his leadership of Shell. It was during the tumultuous so called “transformation” tenure of Sir Mark (when everything seemed to be going wrong and with thousands of Shell employees being made redundant) that the calamitous decision was taken by his management to conjure up higher oil and gas reserve figures: five “Value Creation Teams” were formed, one of which was tasked with “creating the maximum value from Shell’s hydrocarbon reserves.” This was the recipe for the reserves scandal which has destroyed Shell’s reputation.

The gaping loophole in Shell’s SGBP’s exploited by Sir Mark and his colleagues allowed the public, Shell employees, its suppliers and shareholders to be deceived in regards to Shell’s reserves situation (and other matters) without any fear of investigation or redress for any breach of the principles. They can therefore be fairly described as a Confidence Tricksters Charter, which in Shell’s case has been used to create a false sense of trust, confidence and security among the above target audience; a situation which is in surely counter to the public interest.

By way of background information, we were a Shell supplier and formally had a mutually successful long term relationship with Shell on an international basis. We are also Shell shareholders of long standing. When we realised that Shell was not the company it pretended to be, my son and I co-founded the Shell Corporate Conscience Pressure Group which hundreds of Shell retailers, shareholders and suppliers joined. 1400 Shell retailers participated in surveys focused on Shell’s ethical conduct. The survey reply envelopes were opened and the results verified by an independent solicitor. A list of members and an Affidavit from the independent solicitor were supplied to the Advertising Standards Authority in support of the full page announcements of the survey results (which were devastatingly bad for Shell) published in UK petrol retailing magazines and on a website advertised in the UK media and internationally in Time Magazine.

The disputes culminated in a High Court trial which, for a variety of reasons, including sinister activities admitted by Shell, was about as far removed from a fair High Court trial as it is possible to get. Suffice it to say that like many other NGO’s targeted by Shell, we were besieged by undercover agents. The scope of the underhand activities (sabotage, deception, infiltration etc) carried out at Shell’s behest on an international basis, often by a private spy firm in which senior Shell directors were the shareholders/spymasters, only came to light following an investigation by The Sunday Times. It was only when its agents were exposed by the Sunday Times investigators (or in our case caught red-handed) that Shell admitted using undercover agents. I will write to you separately regarding this aspect of our relationship with Shell: the even darker side of Shell.

However, the purpose of this letter is to draw the attention of your government once again to the totally unsatisfactory situation in regards to voluntary Codes of Practice (and Corporate Social Responsibility programmes) which, because of their non-legal status, has allowed companies such as Shell to exploit the relevant legal loophole.

The Guardian published two articles relating to this general subject on 8 November 2004. The first, entitled “Revelation, chapter one”, actually quoted Shell’s SGBP’s main mantra – its claimed "core values of honesty, integrity and respect for people". The second, under the headline of “Forum filling”, included the comment that: "Only binding legal measures will establish a general incentive for responsible corporate behaviour which matches their general incentive to be profitable."

As you will probably be aware, if a company is accused of making false claims in advertising of its products or services, there is recourse to an independent regulatory body (the Advertising Standards Authority). It will investigate if deemed appropriate and if any advertised claims are judged to be false or exaggerated, the ASA finding is published and the guilty party is publicly admonished. There are a variety of other regulators to whom the public can turn dependent on the type of complaint/service industry involved.

However, I stress again that there is no such regulator or mechanism in respect of Codes of Practice (or CSR Reports). They are totally unregulated and are not subject to any law, national or international. Like a bet based with a bookie, they are binding in honour only.

When we wrote to you we supplied with our letter a document entitled “A UNIQUE INSIGHT INTO SHELL”. It revealed the vast credibility gap between on the one hand Shell management’s widely published pledges to honour Shell’s SGBP's and on the other, the reality of its actual deeds. We detailed how Shell management had knowingly engaged in a deeply ingrained corporate culture of cover-up and deceit – in other words had driven a coach and horses through Shell’s own ethical code. I also provided in the same document the quotes from the previously mentioned speech by Mark Moody-Stuart when he referred to Shell’s core principles – “of honesty, integrity and respect for people”. Such passionate pledges have been given many times by Shell management.

A speech given by a Shell executive, Mr Adrian Loader, on 23 February 2004 entitled “Putting principles into practice” is highly apposite to the subject of this letter. At the start of his speech at a business seminar in Singapore focusing on “Developing Corporate Social Responsibility”, Mr Loader quoted at length from a code of practice which his audience naturally thought was Shell’s SGBP’s. The language was indeed forthright and very similar in many respects to that used by Shell management as per the stirring examples already indicated. Mr Loader then sprung a surprise on his audience. He said that every word was taken directly from the Enron Corporation Code of Ethics.

Mr Loader claimed that he had not intended “to poke fun at the high minded aspirations of another energy company, but to remind us that high minded aspirations are just that – high minded aspirations – unless they have the benefit of a corporate culture that is fully committed to putting its aspirations into practice”. It is an unfortunate irony that within literally a matter of days after his speech, the then Group Chairman of Shell, Sir Philip Watts, was forced to resign in disgrace and that following the subsequent release of internal incriminating emails concerning the reserves cover-up at the highest level of his management, Shell’s reputation is now on a par with the likes of Enron and WorldCom in terms of global odium and notoriety.

It is notable that Mr Loader stated in his speech in relation to Shell’s SGBP’s that “Some non-government organisations argue that companies will only act if they are forced to do so by mandatory international codes.” As could be expected, Mr Loader argued on behalf of Shell for the voluntary approach. His speech and other speeches by Shell management often use the term “confidence”. This is a key word because that is the main purpose of such codes – to generate confidence in the company, its products and in relation to its claimed Corporate Social Responsibility, now seen as a vital tool in promoting and improving the public image of some of the world’s largest corporations. The rhetoric can unfortunately mask corporate activity which in fact makes things worse for the communities in which they work.

“Some of those shouting the loudest about their corporate virtues are also among those inflicting continuing damage on communities where they work - particularly poor communities…”: This is a quote from Andrew Pendleton, senior policy officer at Christian Aid and author of a related report, “Behind the mask” from which some of the above phrases are taken. Mr Pendleton argues that “Legally binding regulation is now needed to lessen the devastating impact that companies can have in an ever-more globalised world.” His report findings are that companies have used an image of social responsibility to oppose regulation and convince governments in rich countries that business can put its own house in order.

Shell circulated to its shareholders earlier this year "The Shell Report 2003". A section on page 25 is devoted to Shell's reputation. Alongside the hype about survey results carried out in 2003, is an endorsement of Shell's ethical policies by "Transparency International" -which promotes business ethics and, as its name implies, "transparency". The organisation's endorsement was within the stated context of the so-called "Panels of external experts", who "gave their independent views of how well Shell has performed." All very impressive! What was not disclosed is that George Moody-Stuart, an Executive Committee member of the organisation (and its former Chairman) is the brother of Sir Mark Moody-Stuart, a current director of Shell Transport. Shell shareholders might have been less impressed by the so-called “independent” ethics endorsement if they had known about that undeclared connection: so much for transparency.

I pointed out the questionable basis of this "independent" endorsement to the Head of Corporate Governance at The Association of British Insurers (I also sent a copy of the email to Shell directors). To my surprise Shell Legal Director/General Counsel, Richard Wiseman, mistakenly sent me a copy of his subsequent related internal email to his senior colleagues, Jeroen van der Veer, Chairman of the Committee of Group Managing Directors of the Royal Dutch Shell Group (now Chief Executive of Royal Dutch/Shell) and his Vice Chairman, Group Managing Director, Malcolm Brinded. Mr Wiseman's email, dated 24 June 2004 stated: "I am getting PX to send out our usual response to the association of British Insurers. I will also let Mark Moody-Stuart know that Donovan is now accusing Mark's brother of being in on the act." Although the tone was disparaging it is revealing and flattering to know that (a) my comments reverberate and clearly generate concern right at the very top of Shell and (b) Shell management has a defence strategy in place ready to react instantly to my humble initiatives. I suspect that you will be hearing from them shortly.

Shell has in fact spent millions on promoting on a global basis its good corporate citizen image – for example in its “Profits and Principles” campaign. However, while pledging honesty and openness, Shell senior management deliberately engaged in a massive deception and cover-up in regards to its energy reserves.

As will be evident from the information set out below, no one could have done more over the last several years to set alarm bells ringing far and wide about the ethical flaws in Shell senior management. Our prophetic warnings have turned out to be accurate.

The same management that was responsible for the Brent Spar debacle, the worst excesses in Nigeria and our own horrendous experiences with Shell were also responsible for the reserves scandal which has contributed to global uncertainty over oil supplies and consequently the vastly increased energy costs which threaten the world economy.

In the face of all commercial logic and commonsense some of these senior management figures are amazingly still at the helm of Shell while others have been forced out in disgrace, but with multi-million pound settlements. Shell has already paid $150 million in fines to the SEC and the FSA. A criminal investigation is underway by the US Justice Department. An article in the Daily Mail on 19 October 2004 reports that the US authorities intend to apply for extradition of at least one former Royal Dutch Shell Group Chairman. The scandal was recently described in the BBC TV Money Programme as the biggest investor fraud in history.

The following words and phrases were used in relation to the Shell reserves scandal during the course of the programme: -

“deceit”; “false pretences”; “falsely exaggerating”; “misled the world”; “basically they had been told a lie”; “embellished on the numbers”; “exaggerated the numbers”; “basically we lied to you”; “cover it up”; “doctoring the books”; “inventing numbers”; “certifying the reserve which he knows doesn’t exist”; “reserves replacement and production growth were inflated”; “I am becoming sick and tired of lying about the extent of our reserves”; “cover-up”; “actually destroyed documents”; “the scandal blew up and the company’s reputation carefully nurtured over a century was destroyed”; “Shell has lied intentionally and deceived the public”; “now they know that Shell lied to them and cost them money”; “a fraud perpetrated over a long period of time”; “a fraud perpetrated by the very heads of the company”.

Please note that there was none of the usual caveats which normally precede written statements which would otherwise be labelled as libellous: e.g. “allegedly”. The above descriptions were applied without any such qualification. They were put on record as matters of FACT.

Shell’s SGBP’s played an important role in the scandal as did the Shell Managements propensity to cover-up and deceive – the exact unconscionable failings which we had drawn to your attention. This is not a matter of conjecture or hurling unfounded allegations. Lord Oxburgh, the new Chairman of Shell Transport And Trading Co plc has “apologised unreservedly” for the “inappropriate departure” from Shell’s “Business Principles” in relation to the reserves scandal.

He has touchingly described the lies of Shell management (when, for example it inflated Shell’s future reserves by a $100 billion) as being “economical with the information”. In addition to the apologies and admittances from its management, we also have the incontrovertible evidence of the infamous internal emails at the highest levels of Shell which leave no room for doubt that those involved knew that they were engaged in a cover-up. “Dynamite” was the term used in one email.

An article published by The New York Times on 19 April 2004 also provided illuminating information under the headline: “Shell's Report on Its Troubles Cites Discord at Top”.

Extract from article: "The report also noted that last December, Mr. van de Vijver sent an e-mail message directing a subordinate, Frank Coopman, to destroy a document Mr. Coopman had produced that concluded that the company was "under a legal obligation" to immediately correct overstatements of its proven reserves." Mr van de Vijver was at the time a Group Managing Director of the Royal Dutch Shell Group.

The following extract comes from the same article: "Our story is not one anyone would be proud of, and we have no excuses," said Lord Ron Oxburgh, chairman of Shell Transport and Trading, the British half of Royal Dutch/Shell.

Unfortunately, despite the admissions and apologies the unscrupulous conduct still continues: Please read the section entitled “Dr John Huong and Shell’s SGBP’s” in the enclosed document headed “Ancillary Information” and in particular his whistleblower comments as a former Shell geologist of almost 30 years standing. Eight companies from within the Royal Dutch Shell Group have jointly all brought their legal guns to bear on this Malaysian humanitarian because of his published insights about Shell. He is being sued by Shell for defamation.

I have already provided the extraordinary explicit extracts from the transcript of the BBC TV Money Programme relating to Shell’s reserves scandal. Printed below are a few of the newspaper headlines.

Minneapolis Star Tribune: Dutch/Shell Group exec was 'sick and tired' of lying: 20 April 2004

The Independent: Lies, cover-ups, fat cats and an oil giant in crisis: 20 April 2004

London Evening Standard: Shell 'has lied for 10 years': 25 June 2004

Mail on Sunday: Chairman Jeroen van der Veer in frame over Shell scandal – could lead to 20 years in jail: 6 June 2004

The Times: SHELL SHOCK: The Money Programme provides a clear and merciless indictment of Shell, a company that prided itself on being a safe investment for widows and orphans 10 July 2004

The Guardian: Trail of emails reveals depths of deceit at the heart of Shell: Tuesday April 20, 2004

Daily Telegraph: Memos expose Shell's years of lying: 20/04/2004

The Observer: Ethical funds dump Shell shares: “blue-chip City institutions have confirmed that they have ditched all their Shell shares” Sunday June 27, 2004

The New York Times: Testy Annual Meeting Focuses on Shell's Scandal: “A few of Shell's top executives mislead shareholders and the financial world, he said.”In the United States they'd have been taken away in handcuffs." June 29, 2004

It speaks volumes that Shell has chosen to attack Dr Huong – a Shell veteran – while taking no action against organisations such as the BBC and the newspaper moguls, who like Shell, have huge resources and armies of lawyers. You would know being a lawyer yourself that in any event there is no libel if the alleged defamatory comments are based on fact which is the case with the relevant comments. As indicated, further information about Dr Huong’s situation is contained in the enclosed document entitled “Ancillary Information”.

Shell is itself being sued by several hundred former colleagues of Dr Huong - Shell Malaysia employees who have successfully brought an action alleging that Shell misappropriated employee retirement funds. The case has dragged on for a long time and some of the more elderly claimants have become ill or have passed away. Shell is however appealing the Judges recent verdict which means that more of the surviving claimants are likely to suffer hardship. Shell is adopting these hardball tactics towards its former long serving and loyal employees while handsomely rewarding disgraced senior management figures with multi-million pounds settlements.

I can understand why our comments to you about Shell management were dismissed at the time. We were making what must have appeared to be wild allegations against a highly respected multinational – in 1997 still the biggest oil company on the planet, famed for its legendary advertising slogan, “You can be Sure of Shell”.

Shell Chairman, Mark Moody-Stuart and his successor, Philip Watts were subsequently knighted. Sir Philip has now resigned in disgrace and Sir Mark, like Sir Philip, is a Defendant in a number of Class Action Lawsuits. Both are also the subjects of US criminal investigation in relation to the reserves scandal. Of course Shell is viewed entirely differently now. The Shell management figures we had publicly named as being ethically flawed have together ruined Shell’s once proud reputation as a result of greed, ego and gross incompetence.

You did however take our concerns seriously about the flaw in Codes of Practice which we drew to your personal attention. Following the reply from your Correspondence Secretary we subsequently received a letter from The Office of Fair Trading responding on your behalf. They seemed to share our concerns to a significant extent. The writer, Mary O’Driscoll, hoped that it might be possible to bring about an improvement in standards on a voluntary basis but ended by stating that if necessary “we will have to consider more formal regulatory measures, such as statutory backing for codes”. However, as far as I am aware, nothing has changed in regards to the lack of any legal or regulatory control. Such Codes of practice remain a Confidence Tricksters Charter.

This brings me back appropriately to Shell’s reserves scandal. Shell has, as indicated, paid US$150 million in fines to the SEC and the FSA after restating its reserves on four occasions. It has subsequently warned that a further restatement is in prospect.

I have a copy of a US Class Action Court Document relating to a multi-billion dollar lawsuit being brought against Shell by Pennsylvania State Pension Funds. It runs to nearly 250 pages. There are countless references to Shell’s SGBP’s throughout the document. Shell management used them to underpin the credibility of statutory returns filed with regulatory authorities, including Form 20-F filings with the US Securities & Exchange Commission crucial to Shell’s reserves (and in the filings of Shell Annual Accounts). Extracts are contained in the “Ancillary Information” document under the heading: “THE RESERVES SCANDAL: HOW SHELL USED ITS SGBP’s TO UNDERPIN FALSE FILINGS WITH THE SEC & FSA”.

HOW WE TRIED TO SET THE ALARMS BELLS RINGING

At the time when we contacted you, we also wrote to Shell shareholders, pension fund managers, regulatory bodies, the media, all MP’s, every non-executive director of Shell Transport, Shell UK Ltd and Royal Dutch Petroleum. We even wrote directly to the largest shareholder in Royal Dutch Petroleum, Her Majesty, Queen Beatrix of the Netherlands, warning about the unscrupulous conduct of the executive directors at the helm of the Royal Dutch Shell Group. I have already mentioned the activities of the Shell Corporate Conscience pressure group which I co-founded.

Copies of three relevant leaflets are attached: The first contained a reprint of our letter to Queen Beatrix. The content confirms the huge amount of pressure which was on Mark Moody-Stuart at that time. I warned about "the potential embarrassment caused by the "Royal" prefix being attached to an arrogant multi-national bully, currently in a steep financial and moral decline ("Royal" Dutch/Shell). The letter referred to a leaflet entitled "RETURN OF THE ROBBER BARONS". That leaflet is also enclosed. The closing paragraph stated: "The HQ of Royal Dutch Petroleum, the effective owner of Shell UK (with a 60% shareholding in the Royal Dutch/Shell Group) is located in The Hague, a city renowned throughout the world as being a beacon of justice. It is therefore ironic that Royal Dutch Petroleum is continuing to allow the unscrupulous actions of the British owned (40%) of the Anglo-Dutch group to destroy the reputation of the Shell brand." The third leaflet is entitled “A SLASH AND BURN CULTURE AT SHELL”. It has taken several years and the complete destruction of the "Shell" reputation (as confirmed by independent analyse by a brand reputation expert - Mr Paddy Briggs) for Royal Dutch Petroleum to put an end to its link with Shell Transport. What a pity that our valid warnings were ignored.

We could not have sounded the alarm bells more loudly or more widely about Shell management and how it was exploiting its own globally publicised code of ethics to cloak its unscrupulous, ruthless activities.

In this connection, I have enclosed in the document bundle supplied herein, some illuminating correspondence with the Advertising Standards Authority. One would have thought that if a multinational as part of an advertising campaign, published categorical pledges designed to promote investment in the company and encourage consumers to purchase its products, those pledges would be subject to scrutiny by the ASA. We pointed out in our letter to the ASA that Shell’s SGBP’s is “clearly to position Shell as a highly ethical multinational in which shareholders can have complete confidence.” As can be seen by reading their reply letter, in fact the ASA has no power to intervene.

The current Group Chairman of the Royal Dutch Shell Group, Jeroen van der Veer, has made grovelling apologies for Shell’s disgraceful conduct. He incidentally is also implicated in the reserves scandal having for example signed Form F-20 returns submitted to the SEC which contained materially false information. In view of the admittances and apologies it is astounding that Shell still has the audacity and arrogance to continue to promote its SGBP’s as if nothing untoward had happened.

It’s management apparently believes there are suckers around who will fall for the propaganda peddled in its SGBP’s, still pledging honesty integrity and openness from the same individuals – Sir Mark Moody-Stuart, Malcolm Brinded, Maarten van den Bergh, Van der Veer, etc. I do not believe that Shell is rotten to the core. I believe it is rotten at the core. Shell has over one hundred thousand employees, most of whom are hard working decent people who must be devastated and demoralised at what has happened to Shell.

The reserves scandal resulted from the deeply ingrained corporate culture of cover-up and deceit at the highest levels of Shell. Documents are posted on my website which provide incontrovertible proof of how Shell Chairman, Sir Mark Moody-Stuart, Shell Transport Company Secretary Jyoti Munsiff and Shell Legal Director, Richard Wiseman, were directly involved in hiding information from Shell shareholders, the parties who actually own the company.

Shell knew that its SGBP’s provided a unique unregulated medium of communication which enabled it to say one thing and do another. In the document bundle supplied with this letter, there is specific correspondence on the subject with Mr Richard Wiseman in his capacity as Shell General Counsel/Company Secretary/Legal Director. He confirmed as far back as June 1997 that there was no intention to create a document for use in the courts. He stated that they were intended to “lay down a code of behaviour by which we think we should be judged by the public at large and in this respect perhaps define higher standards than some other commercial organisations impose upon themselves”. He confirmed their non-legal status again in April 2004 when he kindly sent greetings on my 87th birthday.

Information has also emerged about Shell’s conduct in Nigeria. As stated, some of the same Shell management figures are Defendants in a US Class Action Lawsuit brought by leaders of the Ogoni people. The case has been given permission to proceed in the US Courts. Sir Philip Watts and Sir Mark have both been deposed in London in relation to the lawsuit. The Plaintiffs include Mr Charles Wiwa, the nephew of the Nobel Laureate, Ken Saro-Wiwa the Nigerian “Ghandi, a man of great intellect who preached and practiced non-violent protest. After being convicted on obviously trumped up charges, he and eight of his compatriots were hanged in the Port-Harcourt prison on 10th November 1995 by the former Nigerian military regime closely associated with Shell.

The indictment against Shell’s conduct in Nigeria (which is totally at odds with its STATEMENT OF GENERAL BUSINESS PRINCIPLES) is again not a case of making wild allegations. An internal report commissioned by Shell entitled PEACE AND SECURITY IN THE NIGER DELTA is published on my website, Shell2004.com. After a copy was leaked to the news media, Shell management admitted that its actions had indeed fed the violence and corruption in Nigeria – the precise findings in the report which runs to over 100 pages.

Since I am aware of your Chairmanship role in the Commission for Africa, I would draw your attention to an extract from a Paper I authored at the invitation of the National Union of Ogoni Students International. It was presented at a Student Convention in Lincoln Nebraska earlier this year. It is contained in the document headed “Ancillary Information” under the heading: Nigeria and Shell’s SGBP’s.

SUMMING UP: What this all boils down to is that Shell’s SGBP’s has been used as the ethical foundation of the Royal Dutch Shell Group. That important platform has been widely promoted and exploited. Because such codes are free of scrutiny and regulation Shell management has been able to cloak their actions in fine but worthless words. To put it bluntly they have been able to hoodwink the public, suppliers, investors (including pensioners), employees and other parties with impunity based on SGBP’s pledges.

With the greatest respect, that loophole should now be closed.

I hope you will feel it appropriate for the government to eradicate this dream device for those wishing to deceive. It would undoubtedly be in the best interest of the public and other interested parties including investors and pension holders.

Yours sincerely

Alfred

Donovan

Ancillary Information

THE SHELL RESERVES SCANDAL: HOW SHELL USED ITS SGBP’s TO UNDERPIN FALSE FILINGS WITH THE SEC AND THE FSA

Printed below are some salient extracts from the Court Document filed on behalf of the Lead Plaintiffs in one US Class Action Lawsuit against the Royal Dutch Shell Group: -

1. During the Class Period Shell management: (a) Issued false reports; (b) Overstated its reserves replacement ratio; (c) Concealed adverse facts concerning the Companies operations; (d) Artificially inflated the market price of Royal Dutch and Shell Transport securities; (e) Singly and in concert, the Group Defendants engaged in a common plan, scheme, and unlawful course of conduct… that operated as a fraud and deceit..; (f) Overstated future cash flows by over $100 BILLION.

2. The fraud resulted in impairment of the Shell Group’s credit ratings.

3. Shell has not disputed the conclusion that their top management not only knew of the overstated reserves but played for time…

4. Defendants Watt’s, Moody-Stuart, van den Bergh, van der Veer, Skinner, Brinded, Boynton, Miller, van de Vijver and Roels, authorised or signed the filing of Form 20-F to the US Securities & Exchange Commission knowing that the reports were materially false or recklessly disregarded their truth or falsity. To quote from the Amended Complaint: “Each Defendant named in this Count has engaged in some or all of the unlawful acts, transactions and activities alleged herein, including the preparation and/or distribution of false and misleading proxy materials…”

5. During the tenure of defendant, Mark Moody-Stuart, the Shell Group created five “Value Creation Teams”, one of which was tasked with “creating the maximum value from Shell’s hydrocarbon reserves.”

6. There were financial incentives for Shell executives to overstate reserves.

The Shell SGBP’s and pledges relating to the principles, solemnly guarantee that Shell management will enforce them and work within them. Reports and financial statements including Shell Transport and Royal Dutch Annual Reports and Form 20F submissions to the U.S. Securities & Exchange Commission were underpinned in the footnotes by the provisions of Shell’s SGBP’s in relation to corporate governance and internal controls. Shell management’s categorical undertaking that its reports and financial statements were in accordance with its internal principles was stated year after year. The following example is from the 2001 Annual Reports under the heading of “Other Matters”: -

“Within the essential framework provided by the Statement of General Business Principles, the Group’s primary control mechanisms are self-appraisal processes in combination with strict accountability for results.”

The 2002 Annual Reports (paragraph 436 of the Amended Complaint) also contain information about the Companies’ corporate-governance and internal–control policies. Both van der Veer, in his message from the President (of Royal Dutch Petroleum) and Watts, in his message from the Chairman (of Shell Transport), underscored the Companies’ purported commitment to the values of “honest” and “integrity”, and to “having strong corporate governance” and “committing to transparency.” Similar pledges were made time after time, year after year, by Shell’s most senior executives.

Notably, reference was made to the core Shell business principle of “transparency” by Defendant Watts in the following exchange with Bloomberg’s Mr Guy Collins on 8 February 2002: -

COLLINS: I want to ask you about Enron and any parallels there. Do you have any off balance sheet liabilities? Do you have trigger mechanisms in place that make you vulnerable to changes in the share price or credit ratings?

WATTS: Shell is very different from Enron. We were criticized for that some time ago and I’m glad we have a absolutely rock-solid way we do business. And, if you read our annual report, you read our footnotes and all the details, everything is in there. It’s all completely transparent, as far as Shell is concerned.

The reality was very far removed from the pious pledges of transparency and integrity: On 9 November 2003 Royal Dutch Shell Group Managing Director/Boss of Exploration & Production, van de Vijver, sent the following infamous email to the Group Chairman, Sir Philip Watts complaining that he was: -

“becoming sick and tired about lying about the extent of our reserves issues and the downward revisions that need to be done because of far too aggressive/optimistic bookings.”

Weeks later, on 2 December 2002, he sent an email to his Head of Finance at Shell Exploration & Production, Frank Cooper, demanding that an incriminating email about the reserves situation should be destroyed: -

“This is absolute dynamite, not at all what I expected and

needs to be destroyed.”

DR HUONG AND SHELL’S STATEMENT OF GENERAL BUSINESS PRINCIPLES

Eight companies within the Royal Dutch Shell Group are currently jointly suing a courageous former Shell geologist of almost 30 years standing, Dr John Huong. The joint action was launched because I published on my website, ShellNews.net, his whistleblower comments about Shell management misdeeds which specifically contravened Shell’s SGBP’s.

The relevant eight Shell companies from the UK, the Netherlands and the Far East, jointly obtained a Malaysian High Court Injunction intended to remove information from my website, including Dr Huong’s extensive extracts from the UN Universal Declaration of Human Rights which Shell falsely purports to support. Shell lawyers also threatened Dr Huong, a humanitarian, with imprisonment on false grounds. The relevant correspondence is posted on my website.

The following are extracts from Dr Huong’s comments on Shell SGBP’s posted on my website, shell2004.com

I have integrated my personal insights as seen from the perspective of a former Shell employee – a Shell geologist for almost 30 years - who was unfairly axed by Shell management. I was punished because I insisted on working within the ethical boundaries of Shell’s “Statement of General Business Principles” (SGBP) which is supposed to protect shareholder, national and other stakeholder interests.

In my experience Shell directors” and Shell managers, “believe that truth is a precious commodity to be used as a last resort. It has to be squeezed out of them. They prefer to deceive, make empty pledges (Shell's code of ethics), intimidate,” ostracize, “hide information from their own shareholders”, employees, the government who gave them the license to operate and, and finally “retreating behind their army of lawyers” for shelter “whenever there is a prospect that management misdeeds will be exposed."

I was not the only member of staff at Shell who was fired for up-holding Shell’s SGBP. That document had caused untold damage and suffering to many Shell employees. I strongly suggest that Shell suspends the SGBP until such time as Shell management is prepared to honour the noble pledges proclaimed therein. In other words, until the written pledges of integrity and transparency are matched by the actions of Shell management.

It is ironic: If only Shell management had abided by its own ethical code – the SGBP, the humiliating reserves scandal, the results of which will inevitably drag on for many years with the investigations and ruinous class action law suits, could never have occurred. As God is my witness, that is the truth.

I am finding it hard to come to terms with the con-artist mentality of a management which thought it could say one thing in speeches and advertising – pledging “Profits and Principles” - honesty, openness, integrity etc and actually get away and rewarded with doing the exact opposite.

My recipe for recovery: Every single member of Shell senior management who is implicated in or tainted to the least extent by the reserves debacle should do the honorable thing and resign immediately. That includes Mr van der Veer and Mr Malcolm Brinded. Royal Dutch Petroleum and Shell Transport and Trading should be merged into one unified company – Shell with a single management structure. It needs to have an entirely new management team and that will certainly have to think about EXCLUDING Mr. Jon Chadwick – consisting of individuals who have NO possible connection with past misdeeds and who possess the integrity and dedication essential to the considerable task of restoring Shell’s reputation; all of these ingredients are needed for a genuinely fresh start. Only then would I be prepared to invest in Shell or to recommend anyone else to so.

“You Can Be Sure of Shell”. I doubt that Shell management will be using that slogan again for many years after the flood of negative news headlines in the last several months. The Shell brand name has an entirely different connation these days. It stands for deceit, cover-up, dishonesty, pollution, corruption, undercover spies, class action law suits, defective gasoline, exploitation of the poorest people on the planet; support of a murderous military regime, etc - arrogance and evil on a breathtaking scale.

For the record, because English is not his native language, I assisted Dr Huong in drafting many of the comments posted on my site under his name. I have notified the relevant Malaysian Judge accordingly. For some unknown reason, Shell management does not appear keen on facing me in the UK libel courts. Perhaps because they are aware of the overwhelming irrefutable evidence I have in my possession regarding their misdeeds.

NIGERIA & SHELL’S

STATEMENT OF GENERAL BUSINESS PRINCIPLES

On September 20, 2002, fourteen individual plaintiffs including Mr Charles Wiwa, the nephew of the late Nobel Prize Laureate, Mr Ken Saro-Wiwa, filed a class action complaint against Royal Dutch Petroleum and Shell Transport, p.l.c., ("Shell") in the United States District Court for the Southern District of New York charging violations of customary international law under the federal Alien Tort Claims Act relating to Shell’s oil operations in Ogoniland, an area located in the Niger River delta area of Nigeria.

A Judge decided earlier this year that the plaintiffs case had sufficient merit to proceed and as a result Sir Philip Watts and Sir Mark Moody-Stuart were deposed in the UK in April 2004.

We do not have to await the outcome of the case to determine if Shell’s conduct in Nigeria has been inappropriate. A leaked report commissioned by Shell has confirmed that Shell’s activities have fed the violence and corruption in Nigeria. After it was leaked, Shell management admitted the findings were correct. I have reprinted below extracts from a Reuters news story relating to the leaked report. There were many other similar articles.

Reuters: “Leaked” Report says Shell actions feed Nigeria violence: “corporate behaviour of Royal Dutch/Shell in Nigeria feeds a vicious cycle of violence and corruption”

Sun 13 June, 2004 04:35

By Dino Mahtani

LAGOS (Reuters) - The corporate behaviour of Royal Dutch/Shell in Nigeria feeds a vicious cycle of violence and corruption, contributing to the theft of its crude oil, according to a leaked report funded by the oil giant.

And increasing criminalisation of the poverty-stricken Niger Delta could force Shell out of onshore production in Africa's largest oil producer by 2008, the report by consultants WAC Global Services said.

Shell executives acknowledged the company had inadvertently fed the violence, saying it was difficult to operate ethically in the Niger Delta and that its attempts at community development "had been less than perfect".

Finally, the following is an extract from a paper presented at a student convention held in Lincoln Nebraska earlier this year which I had the honour of writing.

EXPLOITATION OF THE OGONI PEOPLE: I was stationed in Palestine in the 1930’s. I regret to say that the Arabs were treated with distain and generally viewed as being second class citizens in their own Countries. How things have changed. The Arabs were sitting on top of the worlds largest oil reserves. Quite correctly, citizens in the oil rich Arab nations have benefited from their own natural resources and are now among the wealthiest people in the world. They have considerable power, influence and respect.

It is impossible to reconcile that situation with what has happened in Nigeria where the population has been oppressed and exploited by Shell and successive Nigerian regimes and Ogoniland has been subjected to long term ecological degradation. While the Ogoni people sit on top of oil fields, but remain abysmally poor, Sir Philip Watts sits on an $18 million (US dollar) pension pot. It is simply obscene and indefensible. After yet another document meant for consumption solely by Shell management was leaked to the press in mid June, Shell was forced to admit that its actions in Nigeria fed “a vicious cycle of violence and corruption”.

Under the circumstances, it speaks volumes that the Ogoni people have not resorted to violence, but are pursuing a legal peaceful campaign to right a monumental injustice.

THE DOCUMENTS ENCLOSED WITH THE LETTER

(CLICK ON EACH LINK TO ACCESS THAT ITEM)

Acrobat Reader is needed to access the files below. Please be patient when downloading as the first file contains multiple pages. (To download a FREE Acrobat Reader click on the adobe link): http://www.adobe.com/products/acrobat/readstep2.html)

10. Response email from Mr Wiseman also dated 22 April 2004.

THE LEAFLETS

Leaflet reprint of my letter to Queen Beatrix dated dated 1 March 1999

Related leaflet entitled: "RETURN OF THE ROBBER BARONS"

Leaflet entitled "A SLASH AND BURN CULTURE AT SHELL"

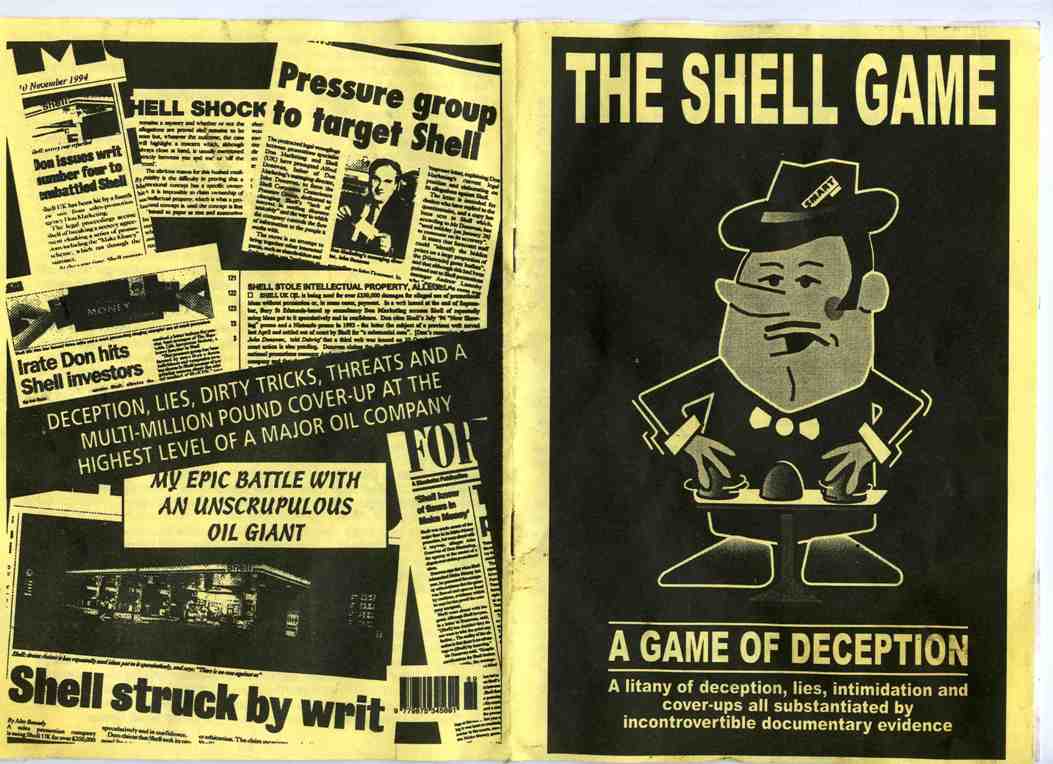

Related booklet entitled THE SHELL GAME (mentioned in one leaflet)

Click the image to view a larger version

Click here for ShellNews.net HOME PAGE